This coming Sunday September 12th , 2021, Cardano is going to launch it’s Smart Contract capability which will allow the Cardano Blockchain to host dApps, DAOs, DeFi Platforms, Decentralized Exchanges and all the good stuff that crypto has to offer. This will allow the usage and the transaction of Tokens on the Cardano blockchain.

Simultaneously IOG (Input Output Global, the research and development company of

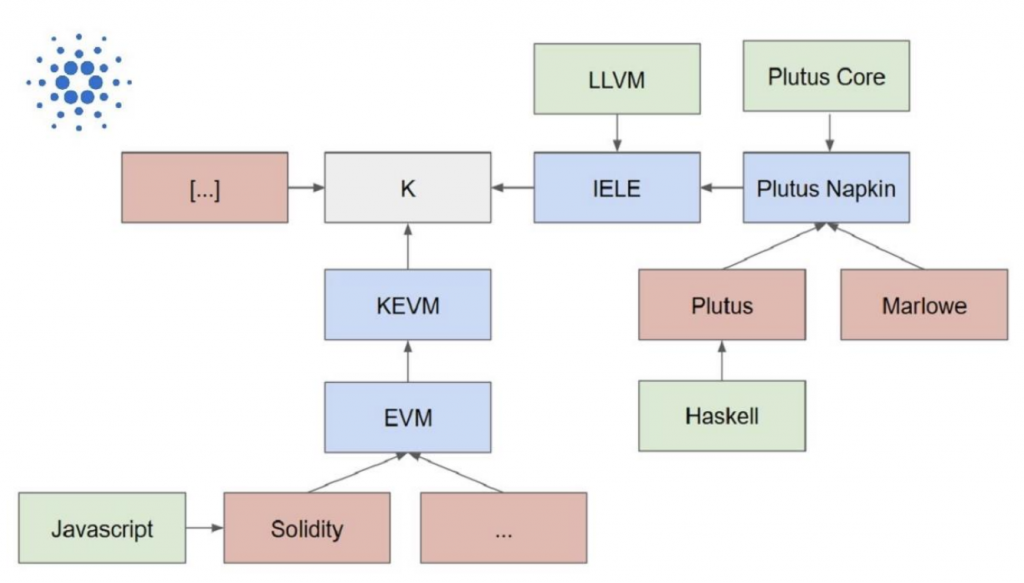

Cardano) is going to launch an ERC-20 Converter. This allows to easily convert Tokens that run on Ethereum to Tokens that run on Cardano EVM. EVM (Ethereum Virtual Machine)

on Cardano allows the interpretation of Ethereums contract language Solidity.

Cardanos native language is Plutus which will run on IELE. Plutus draws from modern language research to provide a safe, full-stack programming environment based on Haskell, a functional programming language.

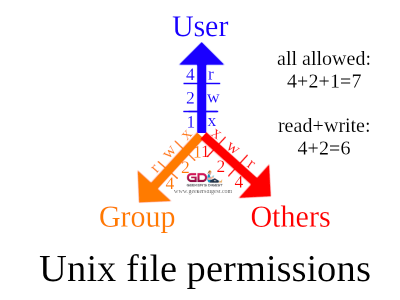

But why would anyone want to convert a Token from Ethereum to Cardano? The loss of money due to transaction fees. Since 2017 and the ICO mania there was a problem on Ethereum and Bitcoin, as soon as the networks got used a lot, the fees for a simple transaction skyrocketed. This is due to some limitations of Proof of Work consensus algorithms.

BTC and ETH and the increasing transaction fees

Every time you send Ether or a Token from an address to another you have to pay the miners a fee. Since blockspace is limited, as soon as the network gets used a lot and exceeds the block space, you are beginning to bid for a faster transaction. Fees go up.

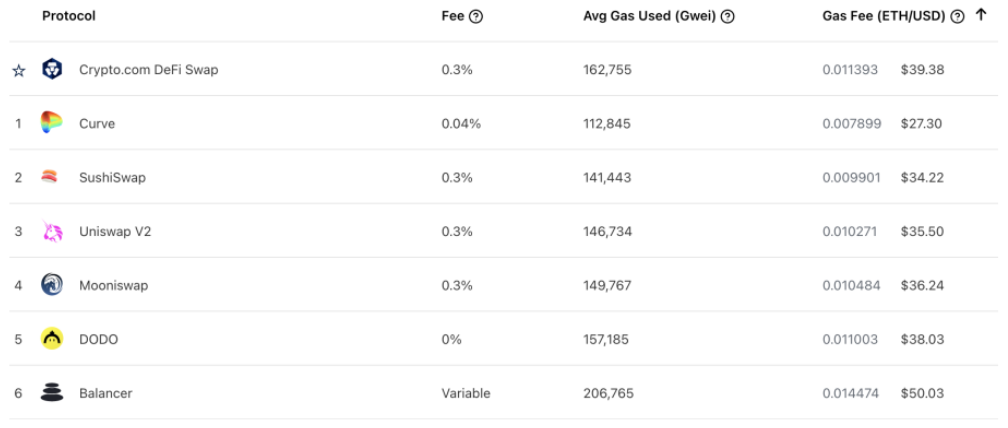

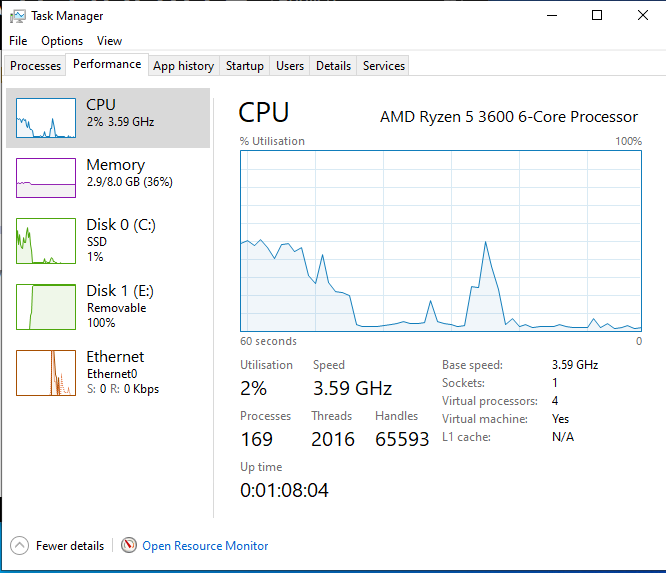

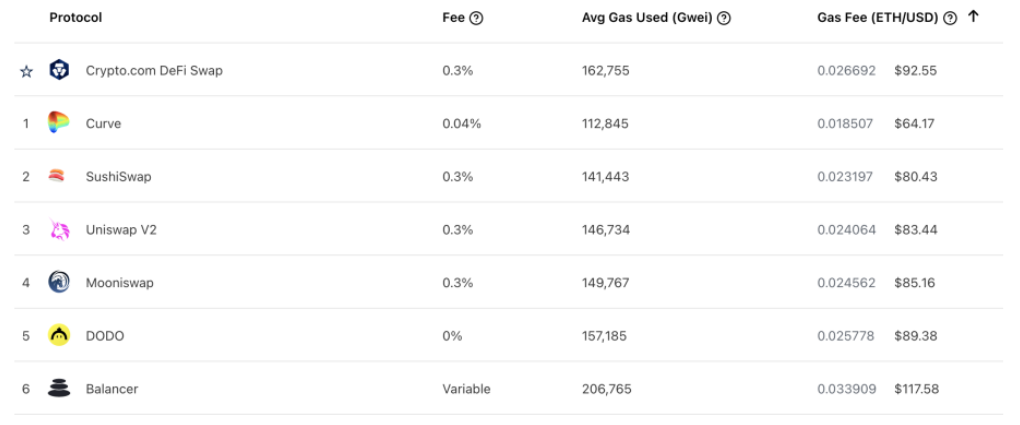

To send a large amount of Ether from Wallet A to Wallet B, this is not the problem, you might pay $8 in Ether. When you swap tokens on uniswap (this is an execution of a smart contract on the Ethereum chain) this can easily cost fees of $40 to $80, depending on how fast you need that transaction to go through. See below screenshots for a real life example.

Standard Swap:

Fast Swap:

This is not a problem for the few wealthy among us. But if you want to create a global financial operating system and include the billions that live on a few or less than a Dollar a day, when you try to become a Bank for the "un-banked", you cannot make the same mistakes as the traditional Banks and charge $40 for a conversion of $50 in a foreign currency. And you don’t take $8 for a $10 transaction. No one would use such a transaction system. And even if you live in a more wealthy country, if you are not in the "1%", when a smart contract costs you $600 to execute, you probably won’t do it. And yes, fees can get that high and even higher.

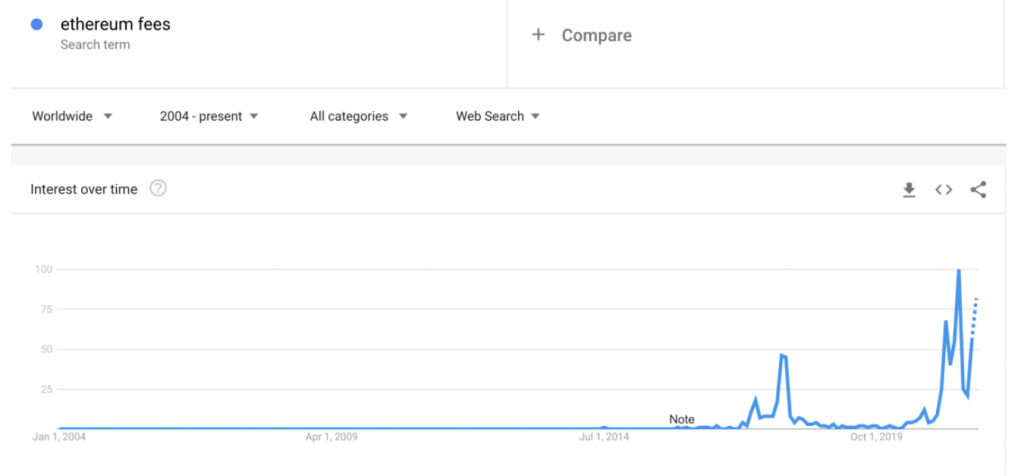

Here is the Google Search trends chart for Ethereum fees in the past years:

It’s obviously an (increasing) issue and people look for alternatives.

Cardano ADA to overtake Ethereum ETH?

On Sunday Cardano will have overtaken Ethereum with having a Proof of Stake blockchain that is able to run Smart Contracts, an easy way to get out of Ethereum (ERC-20 converter), a magnitude less fees, decentralization in thousands of Stake pools and 70% of all ADA already staked. All while Ethereum holders have their Ethers locked in ETH 2.0 with no date when they can use it again, because there is no date yet when Ethereum 2.0 is going to launch. Maybe in Q4 2021 or later. But until then, many projects may have moved on.

Other Smart contract platforms are already making moves. The next years are going to be key

to which are going to be successful and which not.

Smart Contract platforms

Here are some examples for Smart contract platforms:

- Solana

- Algorand

- Elrond

- Sora, Moonbeam, Clover etc. on Polkadot (which itself has no Smart Contract capabilities)

A good list to find additional platforms can be found on CoinGecko.

On Cryptofees.info you can check the fees of different blockchains: Ethereum collects around 56 million in fees daily, Cardano only 56’000.